Here’s What Retirement Looks Like in America in Six Charts

"You can't do anything about the length of your life, but you can do something about its width and depth." – Evan Esar

Americans spend decades saving for retirement, never quite sure how much is enough or what sort of life that money will ultimately buy.

Some aim to build nest eggs of $1 million, $2 million or more, though the majority of people have far less than that to work with. The recent bout of high inflation and market turmoil have added more anxiety to the challenge of making that money last.

To benchmark your retirement plans—including your savings and spending and how you spend your time—one place to start is by looking at how your numbers stack up against Americans overall.

Here is a snapshot of America’s retirement finances:

Retirement Savings

The biggest source of retirement income for many Americans is the nest egg built up during their careers. That usually means balances in retirement accounts like 401(k)s and IRAs.

Total household balances in retirement-type accounts for those 65 and up are $407,581 on average, according to an analysis by the nonprofit Employee Benefit Research Institute based on 2019 data. At the higher end, 11.6% have balances of $1 million or more and 5.7% have balances of $700,000 to $999,999, according to EBRI.

Social Security Benefits

Social Security provides the other major source of income for many retirees. For 12% of men and 15% of women, Social Security comprises 90% or more of retirement income.

Nearly 90% of Americans ages 65 and older received Social Security benefits as of the end of 2022, according to the Social Security Administration. The program allows people to start their retirement benefits any time between ages 62 and 70, and increases the payment for every month of delay.

The average benefit is currently about $1,825 a month, up 8.7% from last year. But benefit amounts range widely, to $3,627 a month for someone retiring at the full retirement age this year. The program calculates benefits using a worker’s highest 35 years of earnings, adjusted to account for average wage inflation.

Health Expenses

Retirees generally spend less on clothing, food and housing as they age. Their healthcare expenses tend to rise.

Households headed by people 65 or older spend an average of $7,030 a year on healthcare, according to the Bureau of Labor Statistics. That breaks down to $4,974 on health insurance, such as supplemental Medicare plans, $1,077 on medical services including eye and dental care, and $726 on drugs such as prescriptions, nonprescription drugs and vitamins and $253 in medical supplies.

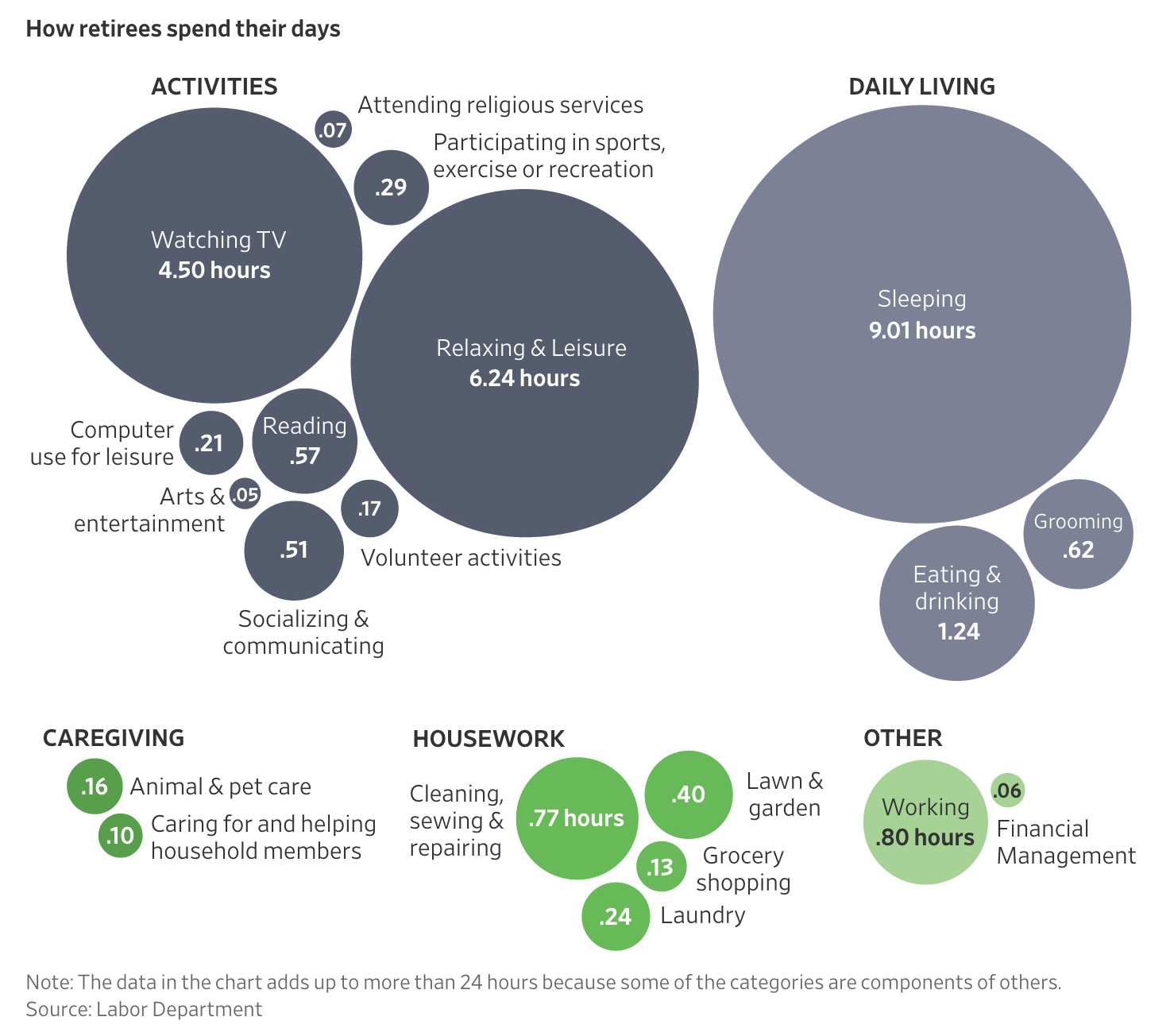

24 Hours of Retirement

Many imagine that in retirement they will travel or pursue the interests they didn’t have time for during their careers. It pays to lay the groundwork for such activities years before retirement, financial advisers say.

On average, Americans ages 65 and older spent more time watching television in 2021 than was the case a decade ago. They also spent more time relaxing and engaged in leisure activities, according to the U.S. Bureau of Labor Statistics American Time Use Survey. Older adults spent less time socializing, volunteering and attending religious services in 2021, compared with 2011.

Net Worth

Americans’ net worth tends to climb with age until retirement. People spend their high earning years accumulating assets, including a home, and building up retirement savings.

Net worth tends to peak around the time many people start spending down their assets in retirement. People 65 to 74 have a median net worth of $266,400 and an average net worth of $1,217,700, according to the Federal Reserve. People 75 or older have a median net worth of $254,800 and an average net worth of $977,600.

Put Your Hard Earned Home Equity to Work for You. Contact Cynthia for a Complimentary Personal Assessment.

If you are 62 or older and you own a house you can take advantage of these benefits. Let’s get started!