The Biggest Retirement Challenge No One Talks About

"The only person you should try to be better than is the person you were yesterday." –Matty Mullins

Retirement means different things to different people. I did a deep survey of more than 15,000 retirees over the age of 60, and asked them one question: “What is your single biggest challenge in retirement?”

Below is a small selection of responses I received under the most cited categories:

Regret:

“I miss doing the work that I love.”

“I don’t think retiring is for me. I want to go back to teaching.”

“I’m not sure what to do with my time. I feel lost.”

Health:

“Keeping my mind healthy and adding value to the world.”

“Fear of dying in pain and discomfort.”

“When you’re 70 with a heart condition, you don’t get that many more bites at the apple.”

Identity:

“Fear of losing my identity created over a lifetime.”

“People do not see you anymore.”

“Feelings of rejection — internalized, not voiced.”

Here’s what this tells us: The biggest retirement challenge that no one talks about, in my experience, is finding purpose.

Sure, money is certainly a concern. “I have a fear of poverty and losing dignity,” one person said. Another wrote: “Money goes out, nothing comes in.” But surprisingly, financial worries weren’t among the top three in the list.

People often confuse retirement savings with retirement planning. But these are two different concepts. Google the words “retirement planning” and you’ll mostly see, for pages and pages, savings-and pension-related content.

There is nothing on actual retirement planning, which I believe is more about your life, and less about money. Having steady finances to last you throughout retirement plays a significant role in quality of life, but what’s more important is your life-planning.

In other words, what is it that you are going to do once you leave the workforce? You can retire from your career, but you can’t retire from life.

Finding purpose leads to a more meaningful, healthier life

In the same survey, I asked how people thought they might solve their challenges. A full 35% believed that the answer is in finding purpose in life through a new skill or interest.

In fact, a 2021 study of 12,825 adults over the age of 51 published in the Journal of Applied Gerontology associated a strong purpose in life with healthier lifestyle behaviors and slower rates of progression of chronic illnesses.

Finding purpose can also help retirees find new side hustle opportunities that bring in income, helping to ease financial concerns.

How a Japanese concept saved me from a depressing retirement

I’ve helped countless retirees find their purpose. They didn’t go back to work in the traditional 9-to-5 sense, but they set up new businesses, consulted, volunteered and took on hobbies that brought them joy and satisfaction.

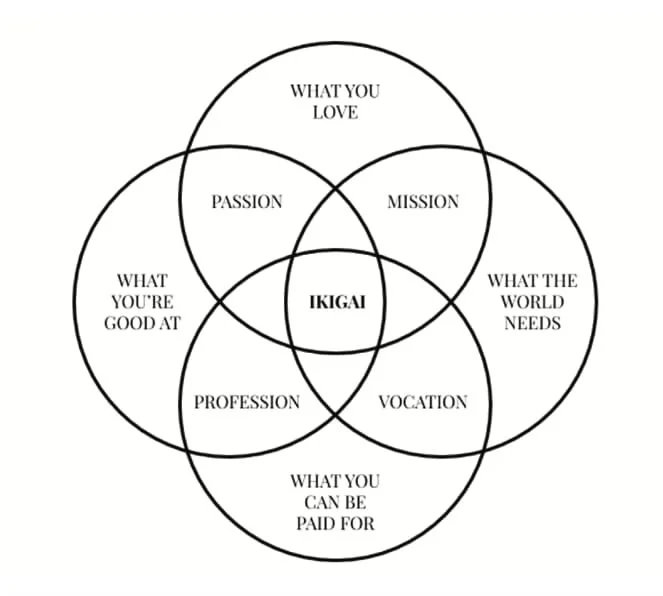

To identify what activities brought me purpose, I referenced the Japanese concept of “ikigai,” which translates to “your reason for being.”

The Westernized version of this concept is based on the idea that there are four components a person must have complete to achieve ikigai.

Each concept is represented by a question. As you actively pursue what you enjoy doing in service of yourself, your family, and your community, think about whether that activity allows you to answer “yes” to any combination of those four questions:

Are you doing an activity that you love?

Are you good at it?

Does the world need what you offer?

Can you get paid for doing it?

Japanese neuroscientist and happiness expert Ken Mogi also suggests considering if the activity has the five pillars that further allow your ikigai to thrive:

Does the activity allow you to start small and improve over time?

Does the activity allow you to release yourself?

Does the activity pursue harmony and sustainability?

Does the activity allow you to enjoy the little things?

Does the activity allow you to focus on the here and now?

On a deeper level, ikigai refers to the emotional circumstances under which individuals feel that their lives are valuable as they move towards their goals.

As for me, I’ve found that my purpose now is to help retirees “un-retire” and create a new life for themselves. Depending on when you plan to retire, you may have another 30, 40, 50 or more years of life — and that’s a hell of a long time to drift aimlessly.

Reverse mortgages are a great and safe way to get financial relief in your retirement years.

If you are 62 or older and you own a house you can take advantage of these benefits. Let’s get started!