NEWS & INSIGHTS

News, insights, tips and resources for seniors to grow older with joy, worry less, and retire well.

The How A Reverse Mortgage Paid Off For Me – Twice

Marie was always careful with her finances, but as she got older, she recognized that much of her money was tied up in her home.

“I overheard a friend talk about how happy she was getting approved for a reverse mortgage and was intrigued,” Marie tells Money Talks News. “I hadn’t heard about reverse mortgages before, but my friend’s situation was similar to mine: widowed, with substantial home equity but limited cash flow.”

So, Marie decided to look into a reverse mortgage for herself.

Home Ownership: A Dream Turned Nightmare for American Seniors

America is facing a housing affordability crisis that’s sidelining countless would-be homebuyers. But there’s another affordability crisis—one that threatens millions of older Americans with the loss of their homes, even if they’re fully paid off. This is truly tragic!

Modern Retirement Problems Require Modern Solutions

Due to a lack of retirement savings, high interest rates, and stubborn inflation, the wheels have fallen off the proverbial retirement wagon. But all hope isn’t lost for those fortunate enough to own their home

5 Surprise Retirement Expenses

These unexpected expenses can derail your retirement. Here's how to get ahead of them.

3 Reverse Mortgage Strategies Available to Homeowners 62+

3 Reverse Mortgage Strategies Available to homeowners 62+ to take advantage of today.Put Your Hard Earned Home Equity to Work. At CDC Solutions, we help unlock the power of your home to enjoy retirement on your terms with family, friends, and the things you cherish most in life.

6 Reasons to Downsize (Rightsize) with Reverse Mortgage?

As we grow older, our housing needs and preferences often change/evolve. The family home that once fulfilled all our needs and still holds a lifetime of memories may begin to feel impractical or burdensome as our family sizes and physical needs change. This is where downsizing, “rightsizing,” or even a move to a more advantageous location is often the best alternative for many homeowners.

Reverse Mortgage FAQs

The Purchase Reverse Mortgage program was designed to allow seniors to purchase a new principal residence and obtain a reverse mortgage within a single transaction by eliminating the need for a second closing. The program was also designed to enable senior homeowners to relocate to other geographical areas to be closer to family members or downsize to homes that meet their physical needs, i.e., handrails, one-level properties, ramps, wider doorways, etc.

The Many Uses of a Reverse Mortgage

The complexion of the Reverse Mortgage industry has changed dramatically over the years. The FHA-Insured Reverse Mortgage is no longer considered a rescue device. Our typical borrower today is in their early 60’s, has excellent credit and upper level income. Discover the Benefits of a Reverse Mortgage today:

2024 Reverse Mortgage Limits Skyrocket

Interest rates are beginning to sneak back down AND last weeks exciting HUD announcement, "INCREASING THE HECM LOAN LIMIT”, will certainly make for new opportunities!. In addition, if you or someone you know applied for a reverse mortgage last year, the actual numbers may have not been favorable. The changes announced will undoubtedly bring about new benefits and would be worth your time to take a quick look.

The New Math of Inheriting Property

One of the first things many people do when they inherit their parents’ home these days is put up a for-sale sign. Deciding what to do with a family property is often both an emotional and financial decision.

This Research-Backed Three-Word Rule Will Save You From a Whole Lot of Regrets.

This Research-Backed Three-Word Rule Will Save You From a Whole Lot of Regrets.

Traditional v.s. Reverse Mortgage: A Comparison

While most people know something about traditional mortgages (also known as conventional mortgages), fewer understand reverse mortgages. In truth, the two financial vehicles have little in common.

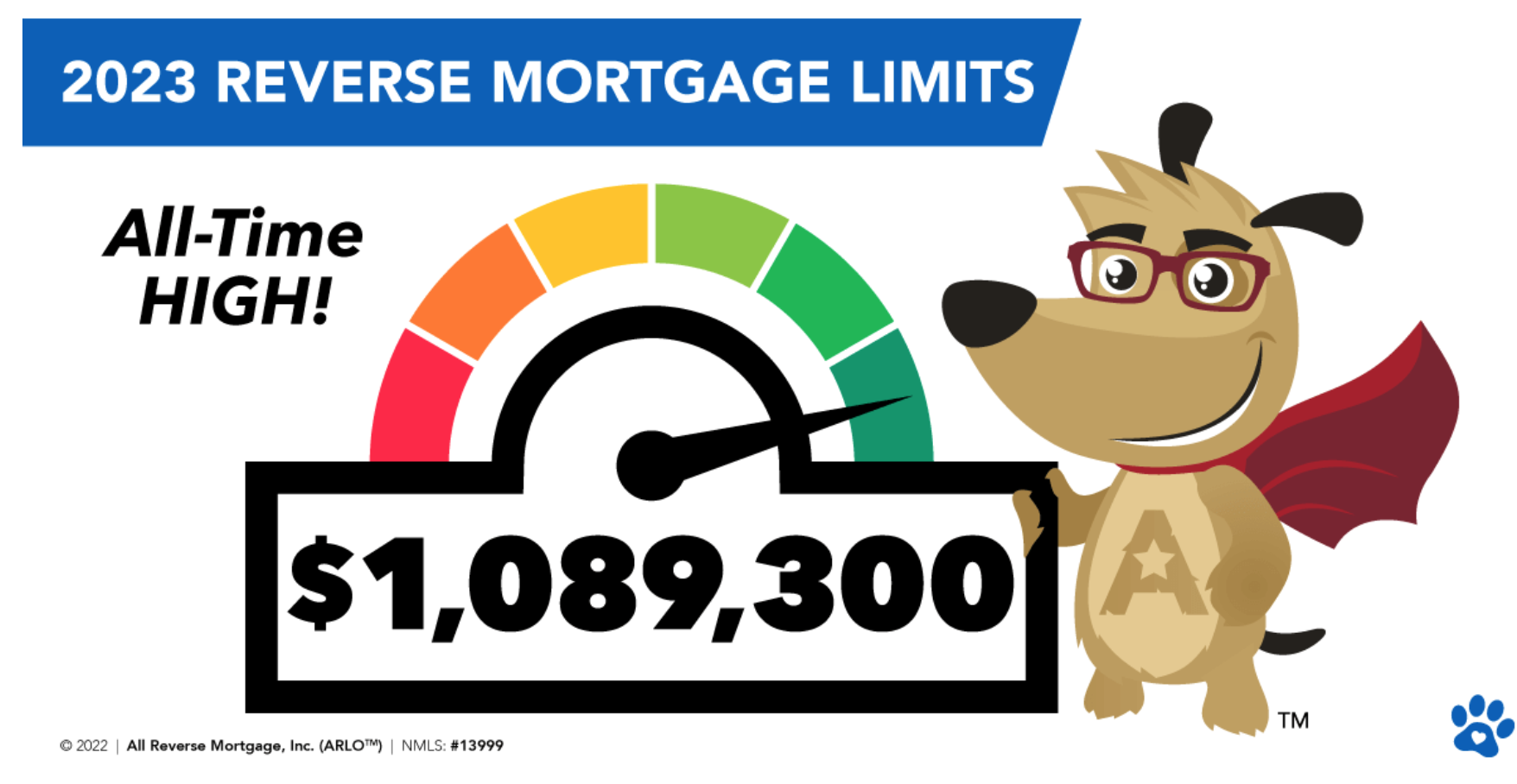

2023 Reverse Mortgage Limits Reach All-Time High

FIRST TIME IN HISTORY HECM LIMIT REACHES $1M+. Now, in 2023, the new limit will be $1,089,300. This is an increase of $118,500!

A New Survey Reveals Americans’ Magic Number for Retirement

The magic number to retire just went even higher. Americans now think their households will need at least $1.25 million to retire comfortably, a 20% jump from a year ago, according to a survey released Tuesday by financial services company Northwestern Mutual.

How Ann Went Far in Retirement by Staying in Her Childhood Home

Childhood House, Forever Home

Like many people, Ann wanted to remain in her home throughout her retirement. What makes her story unique is that her home was the same one she grew up in.

What Homeowners Should Do in a Softening Market?

Are we headed for a major market crash?

Are there things to consider like reverse mortgages to help weather eroding market conditions? Several experts weigh in with their advice…

Can I Keep My Home With a Reverse Mortgage?

Many consumers incorrectly believe that taking out a reverse mortgage means you’re transferring ownership of your house to a bank or lender, but this is not the case. You retain the title to your home. A reverse mortgage just allows you to tap into the equity you’ve built up in your home.

The Pros and Cons of a Reverse Mortgage

The decision to take out—or not take out—a Reverse Mortgage is a big one. Before you apply, it’s always a good idea to speak with a financial advisor to discuss your goals and options. In this article we discuss the Pros and Cons of a Reverse Mortgage

Reverse Mortgage Misconceptions Debunked

There’s a lot of bad information out there about reverse mortgages. Here are the most common myths, plus costs and what the application process looks like to find out if you qualify.

The New Math of Reverse Mortgages for Retirees

Home equity conversion mortgages, commonly known as HECMs, insured by the Federal Housing Administration and overseen by the Department of Housing and Urban Development, offer protections to borrowers that include: limits on how much borrowers can obtain, so seniors don’t opt for large lump-sum distributions they cannot afford; protection from default if the value of the home declines to less than the loan amount; and provisions that secure a surviving spouse’s right to remain in the home after the borrower’s death.