NEWS & INSIGHTS

News, insights, tips and resources for seniors to grow older with joy, worry less, and retire well.

3 Reasons Why More Older Mortgage Applicants Are Denied Credit

Many Americans jumped on the opportunity to harvest some of their home equity as values skyrocketed in the wake of the COVID-19 pandemic. Yet, many older homeowners’ applications for a Home Equity Line of Credit (HELOC) or cash-out refinance were rejected.

While the Equal Credit Opportunity Act (ECOA) prohibits creditors from discriminating against credit applicants based on age, there are exceptions in denying credit based on numerous factors including age. Here are three reasons older credit applicants have a higher rejection rate than younger cohorts.

Three Home Equity Strategies for Baby Boomers

Here are three strategies house-rich baby boomers may choose to leverage the value of their homes. The question is what they will do with it—or, more importantly, what they want to do with their accumulated housing wealth.

The How A Reverse Mortgage Paid Off For Me – Twice

Marie was always careful with her finances, but as she got older, she recognized that much of her money was tied up in her home.

“I overheard a friend talk about how happy she was getting approved for a reverse mortgage and was intrigued,” Marie tells Money Talks News. “I hadn’t heard about reverse mortgages before, but my friend’s situation was similar to mine: widowed, with substantial home equity but limited cash flow.”

So, Marie decided to look into a reverse mortgage for herself.

3 Reverse Mortgage Strategies Available to Homeowners 62+

3 Reverse Mortgage Strategies Available to homeowners 62+ to take advantage of today.Put Your Hard Earned Home Equity to Work. At CDC Solutions, we help unlock the power of your home to enjoy retirement on your terms with family, friends, and the things you cherish most in life.

6 Reasons to Downsize (Rightsize) with Reverse Mortgage?

As we grow older, our housing needs and preferences often change/evolve. The family home that once fulfilled all our needs and still holds a lifetime of memories may begin to feel impractical or burdensome as our family sizes and physical needs change. This is where downsizing, “rightsizing,” or even a move to a more advantageous location is often the best alternative for many homeowners.

Reverse Mortgage FAQs

The Purchase Reverse Mortgage program was designed to allow seniors to purchase a new principal residence and obtain a reverse mortgage within a single transaction by eliminating the need for a second closing. The program was also designed to enable senior homeowners to relocate to other geographical areas to be closer to family members or downsize to homes that meet their physical needs, i.e., handrails, one-level properties, ramps, wider doorways, etc.

2024 Reverse Mortgage Limits Skyrocket

Interest rates are beginning to sneak back down AND last weeks exciting HUD announcement, "INCREASING THE HECM LOAN LIMIT”, will certainly make for new opportunities!. In addition, if you or someone you know applied for a reverse mortgage last year, the actual numbers may have not been favorable. The changes announced will undoubtedly bring about new benefits and would be worth your time to take a quick look.

Older Americans Rejected for a Mortgage May Qualify for a HECM

With Americans more likely to not qualify for a traditional mortgage loan, how many older Americans in this cohort would potentially qualify for a Home Equity Conversion Mortgage?

The answer to that pivotal question may be found in an academic study authored by Christopher Mayer, and Stephanie Moulton, entitled The Market or Reverse Mortgages among Older Americans.

Are You Raiding Your Retirement Nest Egg?

Retirement pessimism may be growing because an increasing number of workers have taken a withdrawal or loans from their retirement plan.

The New Math of Inheriting Property

One of the first things many people do when they inherit their parents’ home these days is put up a for-sale sign. Deciding what to do with a family property is often both an emotional and financial decision.

Ultimate Pick-A-Pay Load for Retiree Financial Distress

If 35-Year-Olds Could Get HECMs, It Would Be the Only Loan in the Country.

Will Home Prices Drop in 2023?

If you’re expecting a crash to make housing affordable again, you may be waiting a while.

This Research-Backed Three-Word Rule Will Save You From a Whole Lot of Regrets.

This Research-Backed Three-Word Rule Will Save You From a Whole Lot of Regrets.

Retirees are Facing These 4 Time Bombs

Older Americans are facing significant challenges navigating today’s uncertain economy. More specifically, they may be at risk of one or more of these retirement time bombs; each of which may, under the right circumstances, be mitigated or even eliminated by tapping into their housing wealth with a reverse mortgage.

Here’s Why People Get Denied for a Reverse Mortgage

Here’s Why People Get Denied for a Reverse Mortgage

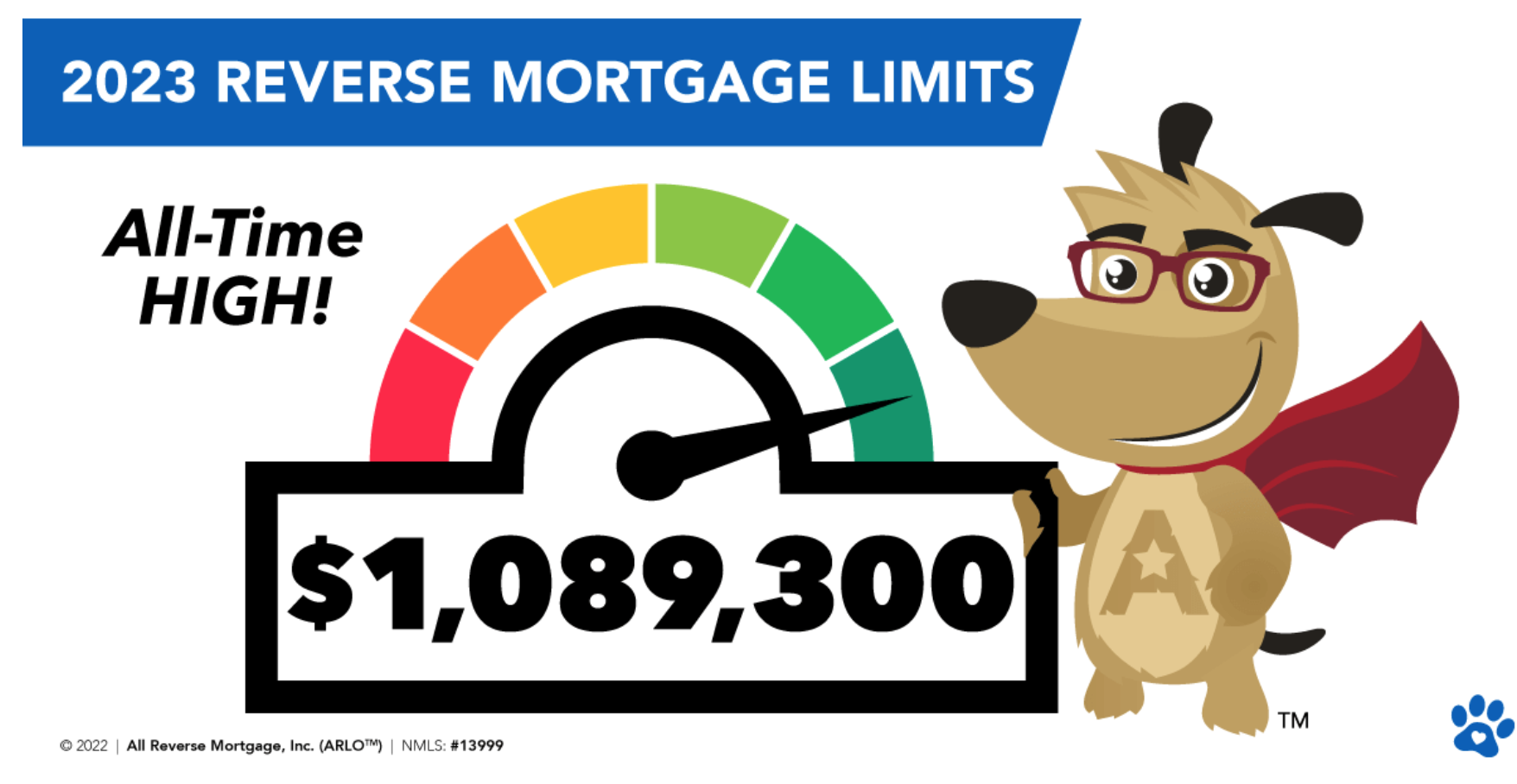

2023 Reverse Mortgage Limits Reach All-Time High

FIRST TIME IN HISTORY HECM LIMIT REACHES $1M+. Now, in 2023, the new limit will be $1,089,300. This is an increase of $118,500!

Plan a Retirement that Lives Up to All Your Adventures

Still Paying Off Your Mortgage in Retirement? Many of us aspire to retire early, but few ever accomplish that goal. The things we do in our professional life are often driven by the age in which we retire. Until we get there, our investments, savings, and other life choices dictate the reality of these goals.

Home Equity Conversion Mortgage for Purchase Explained

Home Equity Conversion Mortgage for Purchase loan allows borrowers to purchase a new home with a reverse mortgage. That means you can complete both the purchase and reverse mortgage transactions with a single set of closing costs with a HECM for purchase. How Does a HECM for Purchase Work?

[Testimonial] Take the Pressure of Paying the Mortgage Off Your Plate.

[Testimonial] With a beautiful home overlooking the Sunset Strip, Keith and Julianne had tremendous home equity growth from the last couple of decades. Instead of moving or living differently in retirement, they found that a Reverse Mortgage gave them the ability to continue to enjoy their lifestyle.

Spring Fever Will Benefit Senior Homeowners

With home prices rising six times as fast as personal income it becomes clear that today’s housing market is both artificial and unsustainable. While the frenzy will eventually subside it won’t stop this spring which marks the height of the home buying season.

![[Testimonial] Take the Pressure of Paying the Mortgage Off Your Plate.](https://images.squarespace-cdn.com/content/v1/5ed7ad9747046a035607d68e/1652476578522-5N68NSN00I9AM0WFUKLX/Julianne+%26+Keith+testimonial+2.png)