NEWS & INSIGHTS

News, insights, tips and resources for seniors to grow older with joy, worry less, and retire well.

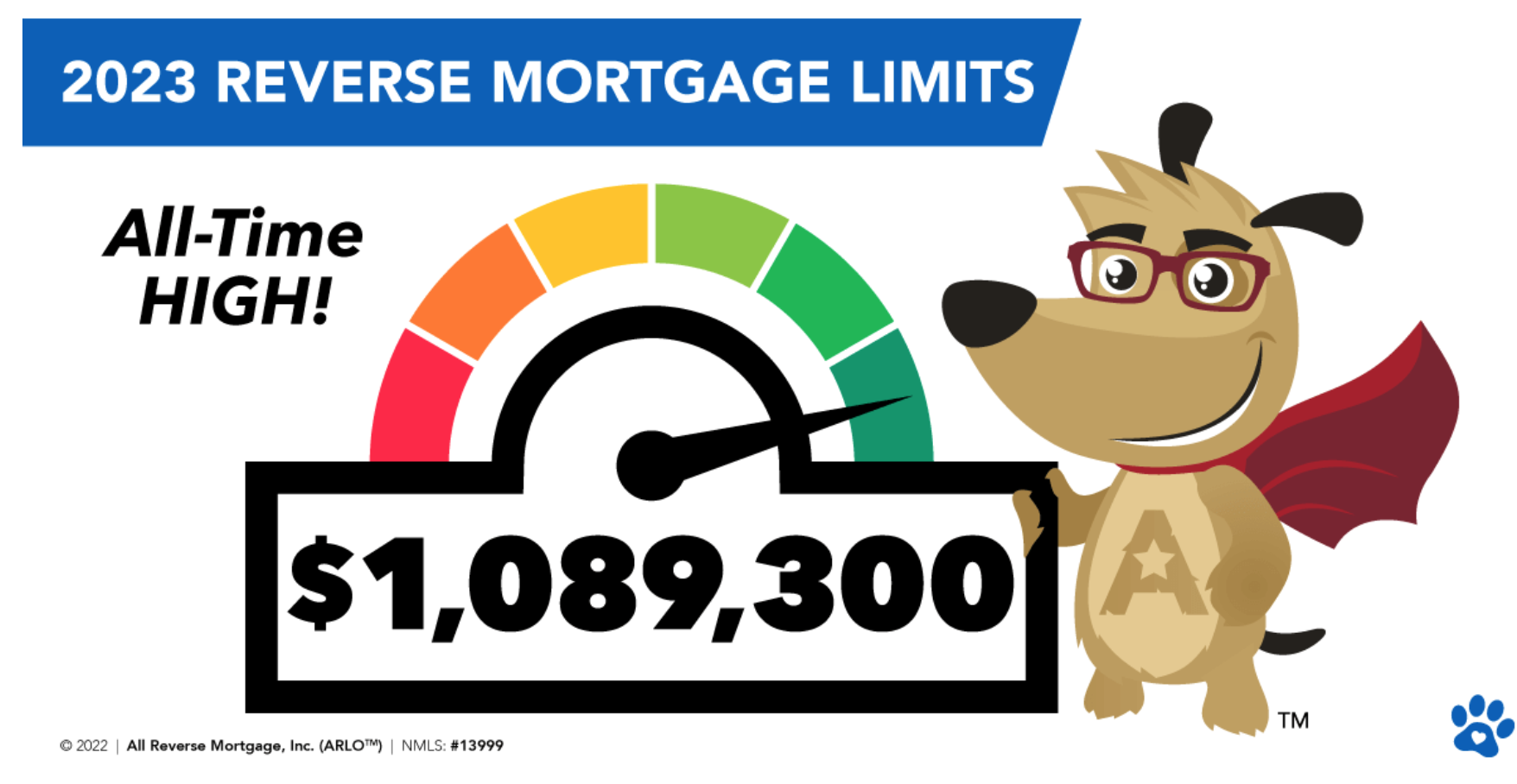

2023 Reverse Mortgage Limits Reach All-Time High

FIRST TIME IN HISTORY HECM LIMIT REACHES $1M+. Now, in 2023, the new limit will be $1,089,300. This is an increase of $118,500!

3 Love Stories for Valentine’s Day

We were so inspired and grateful for the wonderful and thoughtful submissions to our request for "Love Stories”, last week! Although it was tough to decide on just three, we are sharing these with you this Valentine's Day.

A New Survey Reveals Americans’ Magic Number for Retirement

The magic number to retire just went even higher. Americans now think their households will need at least $1.25 million to retire comfortably, a 20% jump from a year ago, according to a survey released Tuesday by financial services company Northwestern Mutual.

💌 Tell Us Your Love Story

I'm looking for any type of LOVE story that has touched your heart, it might be your own or that of another. Love comes in all sizes and colors and can exist between humans and even our sweet loving pets. Any LOVING story that inspires you!!!

How to Create Your Retirement Bucket List

How to Create Your Retirement Bucket List: “A retirement adventure list should guide this next chapter of your life, allowing you to live instead of existing,” says retirement coach Sandra Menzies. What should go on yours? Here’s what experts say about creating a meaningful and realistic list.

How Ann Went Far in Retirement by Staying in Her Childhood Home

Childhood House, Forever Home

Like many people, Ann wanted to remain in her home throughout her retirement. What makes her story unique is that her home was the same one she grew up in.

A Short Story About Gratitude

Today I wanted to share a short story with you about gratitude!

A blind boy sat on the steps of a building with a hat by his feet. He held up a sign which read, “I am blind, please help.” There were only a few coins in the hat – spare change from folks as they hurried past.

A man was walking by. He took a few coins from his pocket and dropped them into the hat. He then took the sign, turned it around, and wrote some words. Then he put the sign back in the boy’s hand so that everyone who walked by would see the new words.

Sassy Senior Sends Glowing Letter to Bank After Check Returned

Seniors may seem frail, but messing with them is never a good idea. Though their bodies have aged, their minds are still sharp as a whip, and their lengthy life experience gives them an upper hand in many situations.

The following letter was sent to a bank manager by an 86 year-old woman after her check bounced, and he thought it was so funny that he sent it to the New York Times to publish. The letter is sure to bring a smile to your face and serve as a reminder that messing with older people is a very bad move indeed!

Here’s the full letter:

8 Ways to Say 'Thank You Veterans' on Veterans Day

8 Ways to say THANK YOU to Veterans on Veterans Day

“On this Veterans Day, let us remember the service of our veterans, and let us renew our national promise to fulfill our sacred obligations to our veterans and their families who have sacrificed so much so that we can live free.” - Dan Lipinski

It’s Time to Throw Out Stereotypes About Aging!

The National Geographic and AARP exclusive study shows that older Americans are redefining their health, defying challenges and living with purpose.

A Reverse Mortgage is Better Than Selling Stocks

Suze Orman on her CNBC show recently responded to a viewer question by stating that a reverse mortgage is a better option than selling stocks.

Managing the Costs of Healthcare in Retirement

Healthcare costs are likely the biggest expenditure in retirement and can fluctuate wildly based on several factors, including age, location, services, insurance plans, and of course, your overall health.

According to the Fidelity Retiree Health Care Cost Estimate, an average retired couple aged 65 will need about $315,000 saved today after taxes to cover health care expenses in retirement.

What Homeowners Should Do in a Softening Market?

Are we headed for a major market crash?

Are there things to consider like reverse mortgages to help weather eroding market conditions? Several experts weigh in with their advice…

Can I Keep My Home With a Reverse Mortgage?

Many consumers incorrectly believe that taking out a reverse mortgage means you’re transferring ownership of your house to a bank or lender, but this is not the case. You retain the title to your home. A reverse mortgage just allows you to tap into the equity you’ve built up in your home.

The History of Aprons

I don't think most kids today know what an apron is. The principle use of Mom's or Grandma's apron was to protect the dress underneath because she only had a few. It was also because it was easier to wash aprons than dresses and aprons used less material. But along with that, it served as a potholder for removing hot pans from the oven.

The Pros and Cons of a Reverse Mortgage

The decision to take out—or not take out—a Reverse Mortgage is a big one. Before you apply, it’s always a good idea to speak with a financial advisor to discuss your goals and options. In this article we discuss the Pros and Cons of a Reverse Mortgage

Reverse Mortgage Misconceptions Debunked

There’s a lot of bad information out there about reverse mortgages. Here are the most common myths, plus costs and what the application process looks like to find out if you qualify.

Plan a Retirement that Lives Up to All Your Adventures

Still Paying Off Your Mortgage in Retirement? Many of us aspire to retire early, but few ever accomplish that goal. The things we do in our professional life are often driven by the age in which we retire. Until we get there, our investments, savings, and other life choices dictate the reality of these goals.

The New Math of Reverse Mortgages for Retirees

Home equity conversion mortgages, commonly known as HECMs, insured by the Federal Housing Administration and overseen by the Department of Housing and Urban Development, offer protections to borrowers that include: limits on how much borrowers can obtain, so seniors don’t opt for large lump-sum distributions they cannot afford; protection from default if the value of the home declines to less than the loan amount; and provisions that secure a surviving spouse’s right to remain in the home after the borrower’s death.

Home Equity Conversion Mortgage for Purchase Explained

Home Equity Conversion Mortgage for Purchase loan allows borrowers to purchase a new home with a reverse mortgage. That means you can complete both the purchase and reverse mortgage transactions with a single set of closing costs with a HECM for purchase. How Does a HECM for Purchase Work?